Low Risk, High ROI

Launch a deposit-driving product in under 90 days. Our Plug-and-Play model ensures minimal IT burden and accelerated speed-to-market, allowing you to prove ROI without core system disruption.

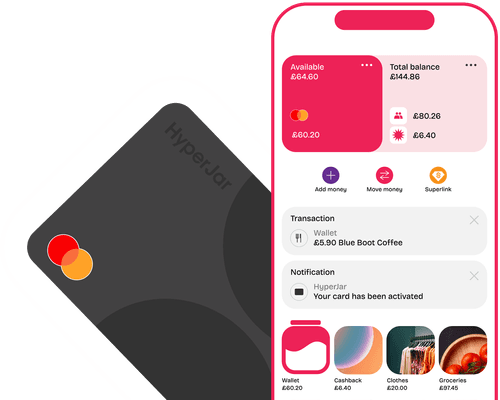

Empower families with intelligent financial tools—while strengthening relationships and increasing engagement with your institution. The Hyperlayer Kids and Senior Companion App is a white-labeled, standalone mobile experience designed for families, guardians, and caregivers. It enables banks to offer a configurable, real-time solution that simplifies family financial management while driving deposits and loyalty across generations.

Give parents and caregivers a clear view of every child’s and senior's account in one place. From monitoring balances to managing permissions, families stay connected and in control—all within your app.

Help parents set up automatic allowances and chore-based rewards. Kids learn to manage spending, saving, and giving—building financial confidence from an early age.

Launch a deposit-driving product in under 90 days. Our Plug-and-Play model ensures minimal IT burden and accelerated speed-to-market, allowing you to prove ROI without core system disruption.

Rapidly deploy a full-featured youth and senior banking app to match and surpass challenger fintechs and neobanks like Greenlight. This immediately defends your retail base and captures new, high-growth family deposits.

Anchor the entire household now to guarantee future primary account holders. This exponentially increases the Lifetime Customer Value (LCV) of your segments and boosts your organization's value.

Maintain control and avoid losing deposits and valuable customer data to third-party apps. Hyperlayer is fully white labeled, enabling you to consolidate the banking relationship across generations under your brand.

We're building the programmable financial fabric that enables institutions to launch, personalize, and scale products without ripping out their core.

We enable institutions to build, hyper-personalize, and deliver financial products at software speed, without ripping and replacing their core.

Finance is at a crossroads. Customers expect personalized, real-time experiences, but legacy transformation paths are too slow and risky. Hyperlayer offers a third way: an orchestration fabric with modular capability blocks and product suites that let institutions launch personalized journeys in weeks, all without replacing their core.

Finance should be as flexible as software. We design everything to give institutions freedom to build and adapt without limits.

We cut through complexity. Whether integration, compliance, or personalization, we deliver outcomes that scale.

We build mission-critical systems with care, precision, and reliability our customers can depend on.

We experiment, explore, and embrace change — pushing boundaries so customers stay ahead of the future.

Financial transformation is a team sport. We co-create openly with customers, partners, and colleagues. Your success is our success.

Hyperlayer is a programmable hyperpersonalization platform that acts as an intelligent orchestration layer and sits above your existing core. Simple APIs mean no rip-and-replace or changes to your existing core investments or third party services.

Absolutely. The solution is fully white-labeled, so every interaction—from onboarding to in-app engagement—reflects your institution’s brand, colors, and values.

Not at all! Our platform is built for low-risk adoption with no core system disruption. Hyperlayer connects through lightweight APIs and can run as a pilot program—allowing you to measure member or customer adoption before a full rollout.

Yes. Hyperlayer meets bank-grade compliance and security standards, ensuring that all data, transactions, and privacy controls align with regulatory requirements and your institution’s risk protocols.

Banks can go live in under 90 days. Hyperlayer’s easy integration ensures minimal IT involvement, allowing your team to test and prove ROI through a low-risk pilot before scaling.

Stand out with our captivating content creation services, tailored to engage today's digital audience

Stand out with our captivating content creation services, tailored to engage today's digital audience

See how our white-labeled family banking solution helps banks capture new deposits and strengthen household relationships. In just 15 minutes, we’ll walk you through the product, rollout plan, and proven path to results.